SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant Registrant: ☒ Filed by a Party other than the RegistrantRegistrant: ☐ Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ☒ | Definitive Proxy Statement |

| |

| ☐ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to§240.14a-12 §240.14a-12 |

Cullen/Frost Bankers, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check

the appropriate box)all boxes that apply):

| | | | | | | | |

| ☒ | | No fee required.required |

| | |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6 (i) (1) and0-11.

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

☐ | Fee paid previously with preliminary materials.materials |

| | |

| ☐ | | Check box if any part of the fee is offset as providedFee computed on table in exhibit required by Item 25(b) per Exchange Act Rule0-11(a)(2)Rules 14a-6(i)(1) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.0-11 |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

A Texas Financial Services Family

100 West Houston Street

San Antonio, Texas 78205

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS To Be Held on April

25, 2018To the Shareholders24, 2024

The Board of

CULLEN/FROST BANKERS, INC.:

The Annual Meeting of Shareholders Directors (the “Annual Meeting”"Board") of Cullen/Frost Bankers, Inc. (“("Cullen/Frost”Frost," "we," "us," or the “Company”"Company") is furnishing you this proxy statement to solicit shareholder proxies to be voted at the 2024 Annual Meeting of Shareholders (the "Annual Meeting") and any adjournment or postponement thereof.

The Annual Meeting will be held in the

Commanders Room at Frost

Bank, 100Tower Conference Center, 111 West Houston Street, San Antonio, Texas 78205, on Wednesday, April

25, 2018,24, 2024, at

11:0010:30 a.m., San Antonio time, for the following purposes:

| | | | | |

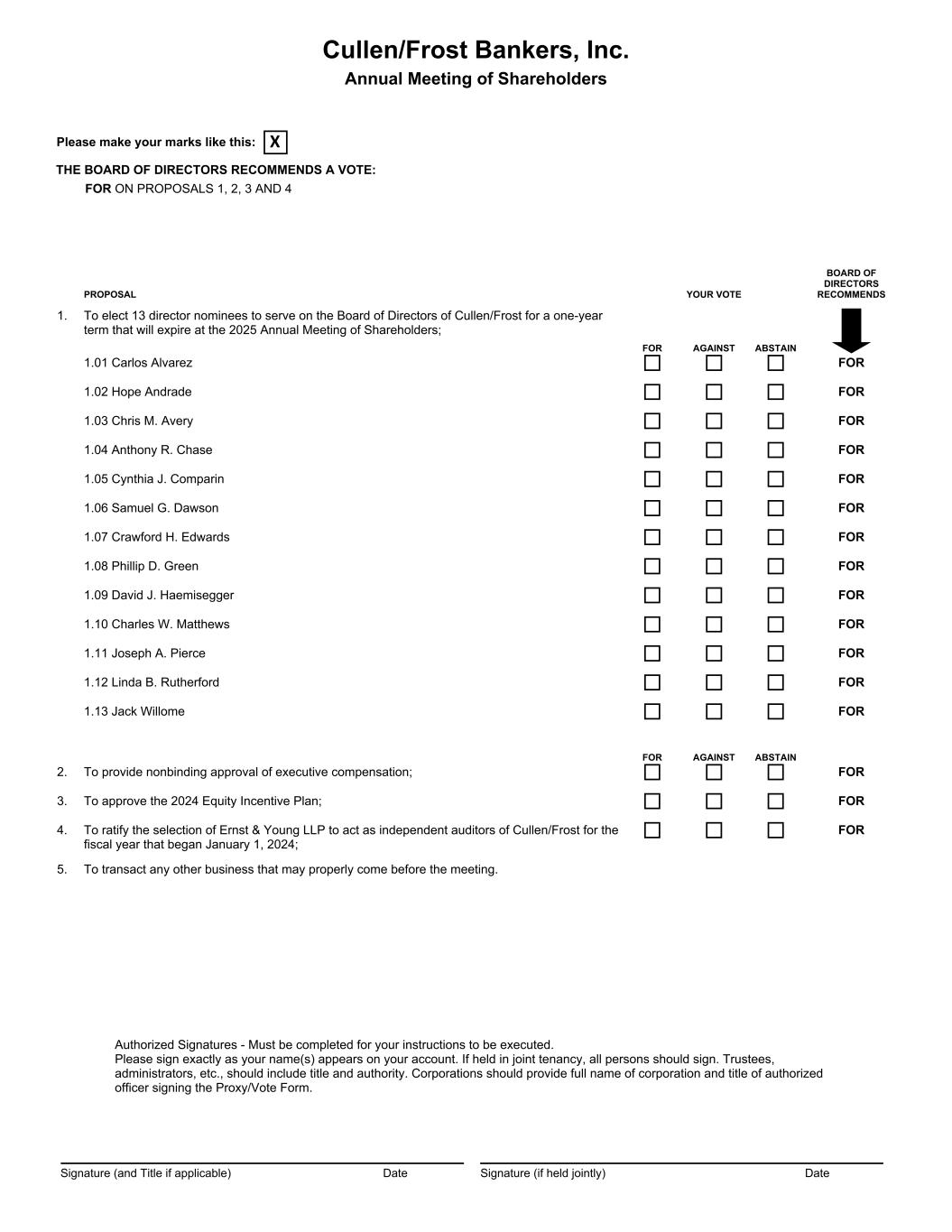

| 1. | 1. | To elect fourteen Director13 director nominees to serve on the Board of Directors of Cullen/Frost for aone-year term that will expire at the 20192025 Annual Meeting of Shareholders;Shareholders. |

| |

| 2. | 2.To provide nonbinding approval of executive compensation. |

| |

| 3. | To approve the 2024 Equity Incentive Plan. |

| |

| 4. | To ratify the selection of Ernst & Young LLP to act as independent auditors of Cullen/Frost for the fiscal year that began January 1, 2018;2024. |

| | 3.To provide nonbinding approval of executive compensation; and |

| 4.5. | To transact any other business that may properly come before the meeting. |

The record date for the determination of the shareholders entitled to

receive notice of and vote at the Annual Meeting, or any adjournments or postponements thereof, was the close of business on March

6, 2018. A list of all shareholders entitled to vote is available for inspection by shareholders during regular business hours for ten days prior to the Annual Meeting at our principal offices at 100 West Houston Street, Suite 1270, San Antonio, Texas 78205. This list will be available at the Annual Meeting.1, 2024.

Your vote is very important. Shareholders of record may vote by following the instructions on their proxy card. You can vote your shares over the internet, phone or email. If you received a paper proxy card by mail, you may also vote by signing, dating and returning the proxy card by mail.

Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy

over the Internet or by telephone or mail in order to ensure the presence of a quorum. If you attend the meeting, you will have the right to

revokesupersede the proxy and vote your shares in person.

Shareholders of record may vote by followingattending the instructions on their proxy card overAnnual Meeting should take the Internet or by telephone or mail.elevators from the Frost Tower lobby to

Floor 15 where Conference Center staff will direct you to the meeting room. All shareholders are cordially invited to attend the Annual Meeting.By Order

We will first mail the Important Notice Regarding the Availability of Proxy Materials for the BoardShareholder Meeting to certain shareholders on or about Friday, March 15, 2024. Shareholders who do not receive the Important Notice Regarding the Availability of Directors,

STANLEY E. MCCORMICK, JR.

Executive Vice President

Corporate Counsel and Secretary

Dated:Proxy Materials for the Shareholder Meeting

will continue to receive a paper copy of our proxy materials, which will be mailed on or about the same day. All proxy materials will be available by March 21, 201815, 2024 at www.proxydocs.com/CFR.

| | | | | |

| By Order of the Board of Directors, |

| | Page | |

| COOLIDGE E. RHODES, JR. |

| Group Executive Vice President |

| General Counsel and Corporate Secretary |

| |

| Dated: March 8, 2024 | |

A Texas Financial Services Family

100 West Houston Street

San Antonio, Texas 78205

PROXY

STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERSTo Be Held on April 25, 2018

INTRODUCTION

The Board of Directors (the “Board”) of Cullen/Frost Bankers, Inc. (“Cullen/Frost” or the “Company”) is soliciting proxies to be used at the Annual Meeting of Shareholders (the “Annual Meeting”) and any adjournment or postponement thereof. The Annual Meeting will be heldSUMMARY

This proxy summary highlights important information contained elsewhere in the

Commanders Room at Frost Bank, 100 West Houston Street, San Antonio, Texas 78205, on Wednesday, April 25, 2018 at 11:00 a.m., San Antonio time. This Proxy Statement and the accompanying proxy

card will be mailed to shareholders beginning on or about March 21, 2018.IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2018 ANNUAL MEETING OF SHAREHOLDERS:

We are pleased to provide access to our proxy materials on the Internet. We have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials on the Internet. This Proxy Statement for the 2018 Annual Meeting of Shareholders and our 2017 Annual Report to Shareholders are available at our proxy materials website at cfrvoteproxy.com. This websitestatement. Since it does not use any functions that identifycontain all the information you should consider before voting your shares, please read the entire proxy statement carefully before voting.

General Information About the Meeting

| | | | | | | | |

| | |

| Date: | Wednesday, April 24, 2024 | |

| | |

| Time: | 10:30 a.m., San Antonio time | |

| | |

| Location: | Frost Tower Conference Center, 111 West Houston Street, San Antonio, Texas 78205 | |

| | |

| Record Date: | March 1, 2024 | |

How to Vote

Shareholders of record as

a visitor toof the

website, and thus protects your privacy.You have the option to vote and submit your proxy over the Internet. If you have Internet access, we encourage you to record your vote over the Internet. We believe it will be convenient for you, and it saves postage and processing costs. In addition, when you vote over the Internet, your vote is recorded immediately, and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted. If you do not vote over the Internet, please vote by telephone or by completing and returning the enclosed proxy card in the postage prepaid envelope provided. Submitting your proxy over the Internet or by telephone or mail will not affect your right to vote in person if you decide to attend the Annual Meeting.

Record Date and Voting Rights

The close of business on March 6, 2018 has been fixed1, 2024 may vote.

| | | | | | | | | | | |

| | | |

| | | |

| Online | By Phone | By Mail | In Person |

| | | |

Registered holders: www.proxydocs.com/CFR

Beneficial holders: Follow instructions provided by your broker, bank, or other nominee. | Call the phone number at the top of your proxy card. | Complete, sign, date and return your proxy card in the envelope provided. | If you choose to vote during the Annual Meeting, you will need the control number appearing on the Notice of Internet Availability of Proxy Materials or proxy card distributed to you. |

| | | |

Your vote is important. Please submit your proxy as soon as possible via the record date for the determinationinternet, mail or telephone. If your shares are held by a broker, bank, or other nominee, it is important that you provide instructions to them so that your vote is counted on all matters.

Proposals

| | | | | | | | |

| Item | | Board

Recommendation |

| | |

| 1. | To elect 13 director nominees to serve on the Board of Directors of Cullen/Frost for a one-year term that will expire at the 2025 Annual Meeting of Shareholders. | FOR |

| | |

| 2. | To provide nonbinding approval of executive compensation. | FOR |

| | |

| 3. | To approve the 2024 Equity Incentive Plan. | FOR |

| | |

| 4. | To ratify the selection of Ernst & Young LLP to act as independent auditors of Cullen/Frost for the fiscal year that began January 1, 2024. | FOR |

| | |

| 5. | To transact any other business that may properly come before the meeting. | __ |

| | |

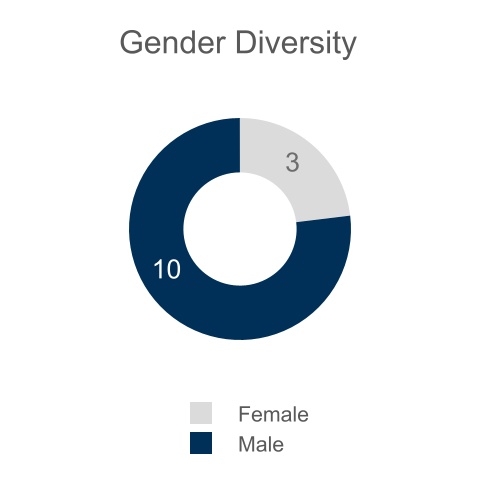

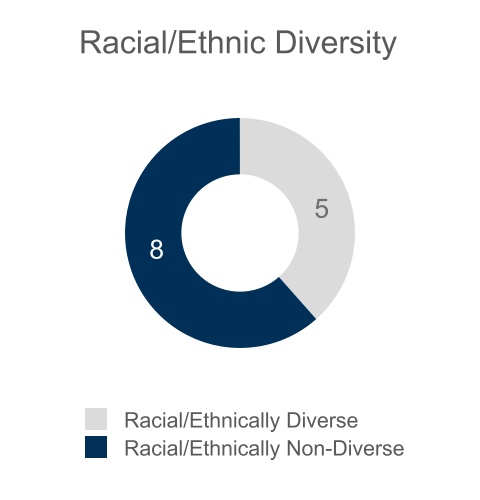

Board Composition of shareholders entitled to vote at the Annual Meeting. Director Nominee Slate

| | | | | | | | | | | | | | |

| Name | Age | Director Since | Independent | Occupation |

| | | | |

| Carlos Alvarez | 73 | 2001 | Yes | Chairman, The Gambrinus Company |

| | | | |

| Hope Andrade | 73 | 2024 | Yes | Partner, Go Rio San Antonio River Cruises and Co-founder, Andrade Van De Putte & Associates |

| | | | |

| Chris M. Avery | 69 | 2015 | Yes | Chairman, James Avery Craftsman, Inc. |

| | | | |

| Anthony R. Chase | 69 | 2020 | Yes | Chairman and CEO, ChaseSource LP |

| | | | |

| Cynthia J. Comparin | 65 | 2018 | Yes | Founder and Former CEO, Animato Technologies Corp. |

| | | | |

| Samuel G. Dawson | 63 | 2017 | Yes | CEO, Pape-Dawson Consulting Engineers, LLC |

| | | | |

| Crawford H. Edwards | 65 | 2005 | Yes | President, Cassco Development Co., Inc. |

| | | | |

| Phillip D. Green | 69 | 2016 | No | Chairman of the Board and CEO of Cullen/Frost and Frost Bank |

| | | | |

| David J. Haemisegger | 70 | 2008 | Yes | President, NorthPark Management Company |

| | | | |

| Charles W. Matthews | 79 | 2010 | Yes | Former Vice President, General Counsel, Exxon Mobil Corporation |

| | | | |

| Joseph A. Pierce | 55 | 2022 | Yes | Senior Vice President and General Counsel, AMB Sports and Entertainment |

| | | | |

| Linda B. Rutherford | 57 | 2022 | Yes | Chief Administration Officer, Southwest Airlines |

| | | | |

| Jack Willome | 77 | 2023 | Yes | Former President, Ellison Industries |

| | | | |

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 1

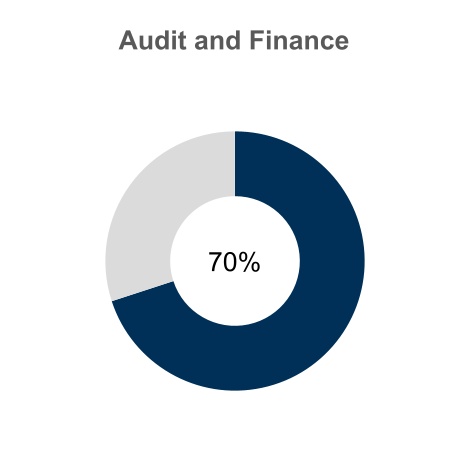

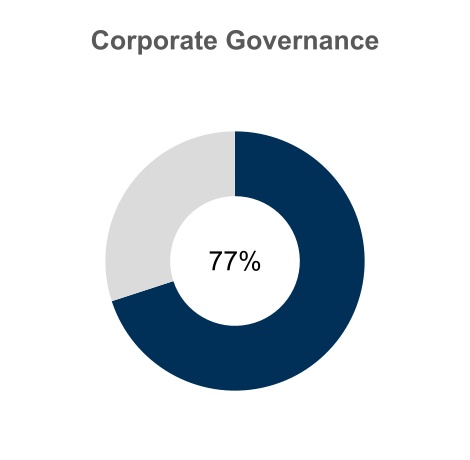

Board Skills and Experience of Director Nominees

The only classBoard of securitiesDirectors of Cullen/Frost outstanding(the "Board") believes that it has the right mix of qualifications, skills, experience, and entitledperspectives that allow it to votefulfill its responsibilities, including overseeing management’s execution of our corporate strategy, which is designed to create long-term shareholder value. The information below shows how the Board’s collective qualifications, skills, and experience relate to the Company’s culture and corporate strategy. For biographical information regarding each of our directors and their individual qualifications, skills, and experience see, "Election of Directors (Proposal No. 1)."

| | | | | | | | | | | | | | |

| | | | |

| Audit and Finance | Experience in corporate finance and audit matters. | | Human Capital Management | Experience in managing people and related employment issues including, but not limited to, compensation. |

| | | | |

| Corporate Governance | Experience in corporate governance and regulatory matters. | | Leadership | Experience as a CEO, senior executive or leader of significant operations. |

| | | | |

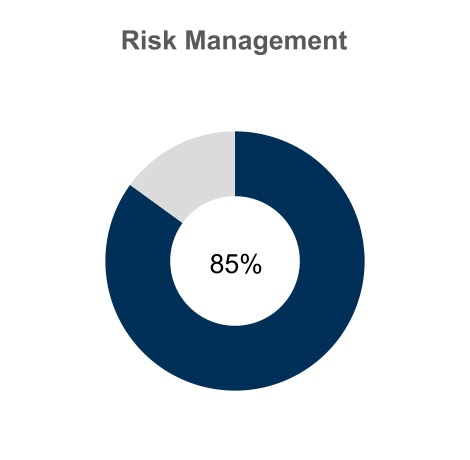

| Culture | Has values and reputation that align with the Frost core values. | | Risk Management | Experience in identifying, analyzing, or mitigating operational, regulatory, or other business-related risks. |

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 2

CORPORATE CITIZENSHIP AND SUSTAINABILITY MATTERS

We believe that the considerations and risks associated with environmental, social and governance ("ESG") matters can best be managed through our corporate culture, including The Frost Philosophy, a combination of our mission statement and our core values of Integrity, Caring and Excellence, which can be found in our Blue Book on our website at frostbank.com/corporate-citizenship.

| | | | | |

| |

| Our Mission Statement |

We will grow and prosper, building long-term relationships based on top-quality service, high ethical standards and safe, sound assets.

|

| | | | | |

| Our Core Values |

| Integrity | A steadfast adherence to an ethical code. We go out of our way to do the right thing, even when no one is looking. Integrity is woven into the very fabric of our business. Since 1868, we've fostered a culture of doing the right thing because it's the right thing to do. We own our successes and mistakes, we treat everyone with dignity and respect, and we always keep our word. |

| Caring | We are committed to investing in our communities and providing support for programs and services which have a direct impact on the people who live and work there. You’ll find our employees actively working in our communities through charitable endeavors, facilitating financial literacy classes and more. |

| Excellence | Commitment to being outstanding. We go above and beyond expectations to deliver sustained superior financial performance and satisfaction for all. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Recognition |

| | | | | | | | | |

| We are honored to be recognized with the following recent accolades: |

| | | | | | | | | |

Highest Customer Satisfaction with Consumer Banking in Texas

14th Consecutive Year

JD Power and Associates

| | | Excellence and Best Brands for 2023

8th Consecutive Year

Greenwich | | | Best Banks of 2023-2024 and Best Customer Satisfaction

Money Magazine | | | Top 250 Best Regional Banks

Newsweek |

| | | | | | | | | |

We believe the Annual Meetingbest way to deliver long-term value is by delivering on our Common Stock, par value $0.01 per share. On March 6, 2018, there were 63,761,096 sharescommitments to every stakeholder we serve – our shareholders, customers, colleagues, and communities.

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 3

| | |

| ENVIRONMENTAL, SOCIAL, AND GOVERNANCE PILLARS |

| | | | | | | | |

| | |

| | |

COMMITMENT TO SOUND CORPORATE GOVERNANCE

We believe that good corporate governance is critical to our long-term success. As a result, in 2023 we adopted corporate governance policies and procedures designed to continue to protect and enhance our corporate integrity and framework for our directors, officers, and employees to conduct business in accordance with high ethical standards.

•We continued to refresh our board and added two new directors since January 2023.

•We revised our Insider Trading Policy to provide for more robust guidance on trading, including the prohibition of pledging and hedging by our directors and executive officers.

•In accordance with the NYSE Rules, we adopted a Clawback Policy.

•We established a cross-functional Responsible AI Council to mitigate the risks of AI and ensure the ethical development and use of AI at Frost.

| |

COMMITMENT TO OUR PEOPLE

We're committed to making a difference in people's lives by creating an inclusive and supportive workplace and by treating people the way they want to be treated. Through our social initiatives, we strive to protect and grow our people by advocating for Diversity, Equity, Inclusion & Belonging (DEI&B), encouraging employee development, creating inclusive teams, fostering a work-life balance, implementing community initiatives, and living our corporate values every day.

•Our DEI&B Executive Governance Council met regularly in 2023 focusing on our DEI&B Strategic Action Plan, 2023 accomplishments, and strategy for 2024.

•In 2023, we hosted DEI&B town halls throughout our regions and also held monthly cultural commemorative celebrations.

•A key aspect of employee development is how we support our employees' professional development and career growth. Our employees participated in over 85,000 hours of formal learning programs and courses throughout 2023. |

| | |

| | |

| | |

COMMITMENT TO OUR COMMUNITIES

We continue making substantial impacts in the communities where our customers and our employees live and work. Through lending, investing, grants, and volunteerism, we participate in the growth, revitalization, and sustainability of the communities we proudly serve.

•In 2023, our employees engaged in approximately 19,500 hours of community service.

•Frost and the Frost Foundation distributed over $5 million in donations and grants to hundreds of organizations in 2023.

•Frost for Good participated in nearly 200 projects for 109 different community organizations.

| |

COMMITMENT TO CONSERVATION Our commitment to conservation begins with understanding our responsibility to care for our environment and the natural resources that benefit humankind.

•In 2023, we established a cross-functional Climate Risk Working Group that reports to the ESG Steering Committee to centralize and coordinate enterprise-wide efforts related to climate risk management. •We created a process that allows us to track quantities of water, metal, cardboard, batteries, and other items that we consume and recycle on a monthly basis at our main operating facility in San Antonio. •We recycled over 1.7 million pounds of paper in 2023. |

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 4

EXECUTIVE COMPENSATION SUMMARY

We enjoy a strong history of

Common Stock outstanding,stable and profitable performance. We believe everyone is significant at our Company and successful performance occurs when everyone works together as a team with

each share entitled to one vote.Proxies

All shares of Cullen/Frost Common Stock represented by properly executed proxies, if timely returned and not subsequently revoked, will be voted at the Annual Meeting in the manner directed in the proxy. Ifcommon goals. As a properly executed proxy does not specify a choice on a matter, the shares will be voted for the fourteen nominees to serve on the Board as Directors (each, a “Director”) for aone-year term that will expire at the 2019 Annual Meeting of

-1-

Shareholders, for the ratification of Ernst & Young LLP to act asresult, our independent auditors for the 2018 fiscal year, for thenon-binding approval of executive compensation programs generally focus on total Company success. Therefore, we generally target our executive compensation to be in a competitive range of our peer group while taking into account various other factors, including market conditions, Company performance, internal equity, and in the discretion of the persons named as proxies with respect to anyindividual experience and performance levels, among other business that may properly come before the meeting.

A shareholder may revoke a proxy at any time before it is voted by delivering a written revocation notice to the Corporate Secretary ofthings. Because we believe Cullen/Frost Bankers, Inc., 100 West Houston Street, San Antonio, Texas 78205. A shareholder who attends the Annual Meeting may, if desired, vote by ballot at the meeting,should be a safe and such vote will revoke any proxy previously given.

Quorum and Voting Requirements

A quorum of shareholders is requiredsound place to hold a valid meeting. If the holders of a majority of the issued and outstanding shares of Cullen/Frost Common Stock entitleddo business, we strive to vote are present at the Annual Meeting in person or represented by proxy, a quorum will exist. Abstentions and brokernon-votes, are counted as “present” for establishing a quorum.

Directors are elected by a majority of the votes cast by the holders of Cullen/Frost’s Common Stock entitled to vote at any meeting for the election of Directors at which a quorum is present, provided that if the number of Director nominees exceeds the number of Directors to be elected at such a meeting, the Directors shall be elected by a plurality of the votes cast by the holders of Cullen/Frost’s Common Stock entitled to vote at such meeting at which a quorum is present. With respect to the election of Directors, (i) a majority of the votes cast means that the number of votes cast “for” the election of a Director must exceed the number of votes cast “against” that Director and (ii) abstentions and brokernon-votes shall not be counted as votes cast either “for” or “against” any nominee for Director.

With respect to the ratification of Ernst & Young LLP to act as our independent auditors for the 2018 fiscal year, the affirmative vote of the holders of a majority of the shares of Cullen/Frost’s Common Stock entitled to vote on this proposal, and who are present in person or represented by proxy at the Annual Meeting, will be the act of the shareholders. In voting for this matter, shares may be voted “for”, “against” or “abstain”. An abstention will have the effect of a vote against this matter.

With respect to the resolution to provide nonbinding approval of executive compensation, the affirmative vote of the holders of a majority of the shares of Cullen/Frost’s Common Stock entitled to vote on this proposal, and who are present in person or represented by proxy at the Annual Meeting, will be the act of the shareholders. In voting for this matter, shares may be voted “for”, “against” or “abstain”. An abstention will have the effect of a vote against this matter. Brokernon-votes (as further discussed below) will have no effect on the outcome of this vote. This resolution is advisory only and will not be binding upon Cullen/Frost or the Board.

Under the rules of the Financial Industry Regulatory Authority, Inc., member brokers generally may not vote shares held by them in street name for customers who do not provide voting instructions, and instead must submit aso-called “brokernon-vote” unless they are permitted to vote the shares in their discretion under the rules of any national securities exchange of which they are members. Under the rules of the New York Stock Exchange, Inc. (“NYSE”), a member broker that holds shares in street name for customers has authority to vote on certain “routine” items if it has transmitted proxy-soliciting materials to the beneficial owner but has not received instructions from that owner. The proposal to ratify the selection of Ernst & Young LLP to act as Cullen/Frost’s independent auditors is a “routine” item, and the NYSE rules permit member brokers that do not receive instructions to vote on this item.

If you hold shares of Cullen/Frost’s Common Stock through the Cullen/Frost 401(k) Stock Purchase Planavoid excessive risk, and do not provide voting instructionsoffer executive compensation programs that would encourage the taking of such risks. Further, we believe that the consistency and continuity of our management team serves to enhance our conservative yet profitable risk profile.

2023 Named Executive Officers

| | | | | | | | |

| | |

| Phillip D. Green | Chairman of the Board and CEO of Cullen/Frost and Frost Bank |

| | |

| Jerry Salinas | Group Executive Vice President and CFO of Cullen/Frost and Frost Bank |

| | |

| Paul H. Bracher | President of Cullen/Frost and Frost Bank and Group Executive Vice President, Chief Banking Officer of Frost Bank |

| | |

| Jimmy Stead | Group Executive Vice President and Chief Consumer Banking and Technology Officer of Cullen/Frost and Frost Bank |

| | |

| Coolidge E. Rhodes, Jr. | Group Executive Vice President and General Counsel and Corporate Secretary of Cullen/Frost and Frost Bank |

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 5

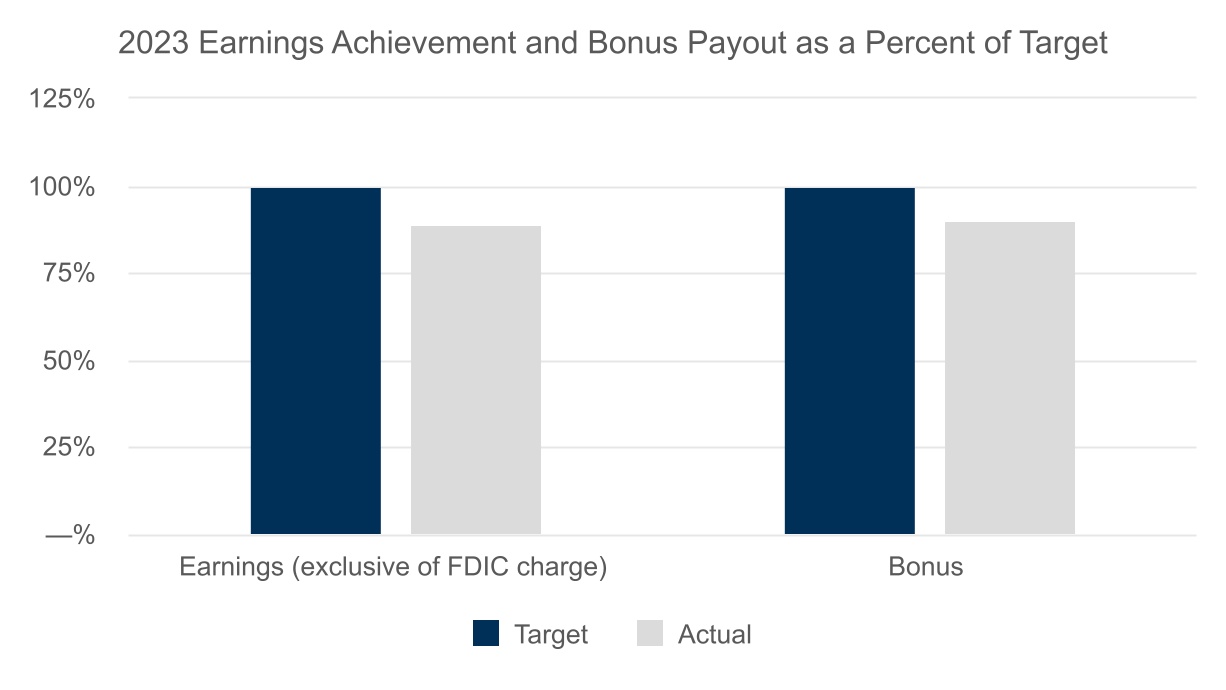

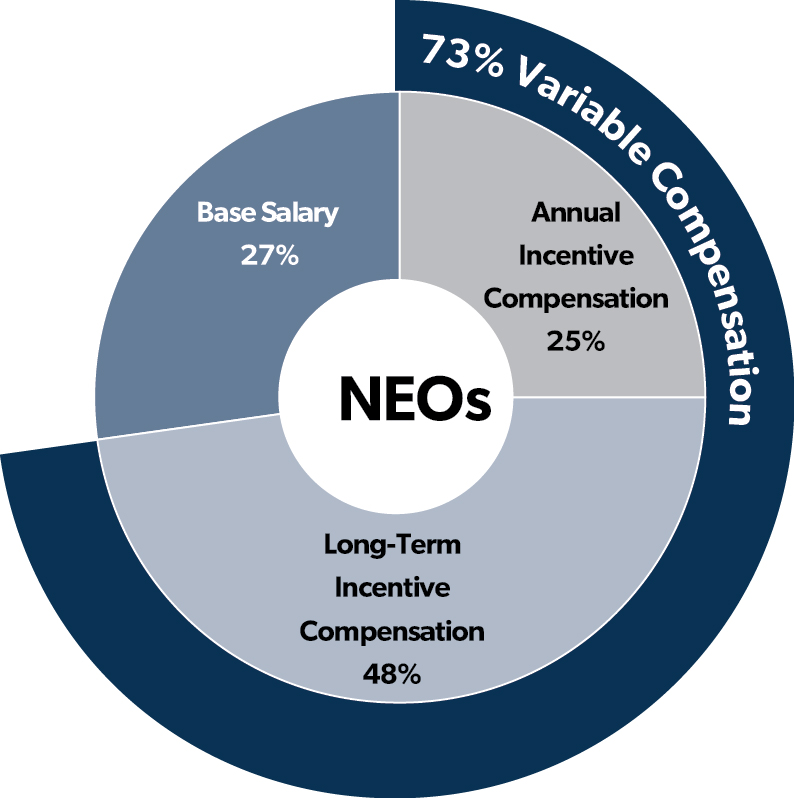

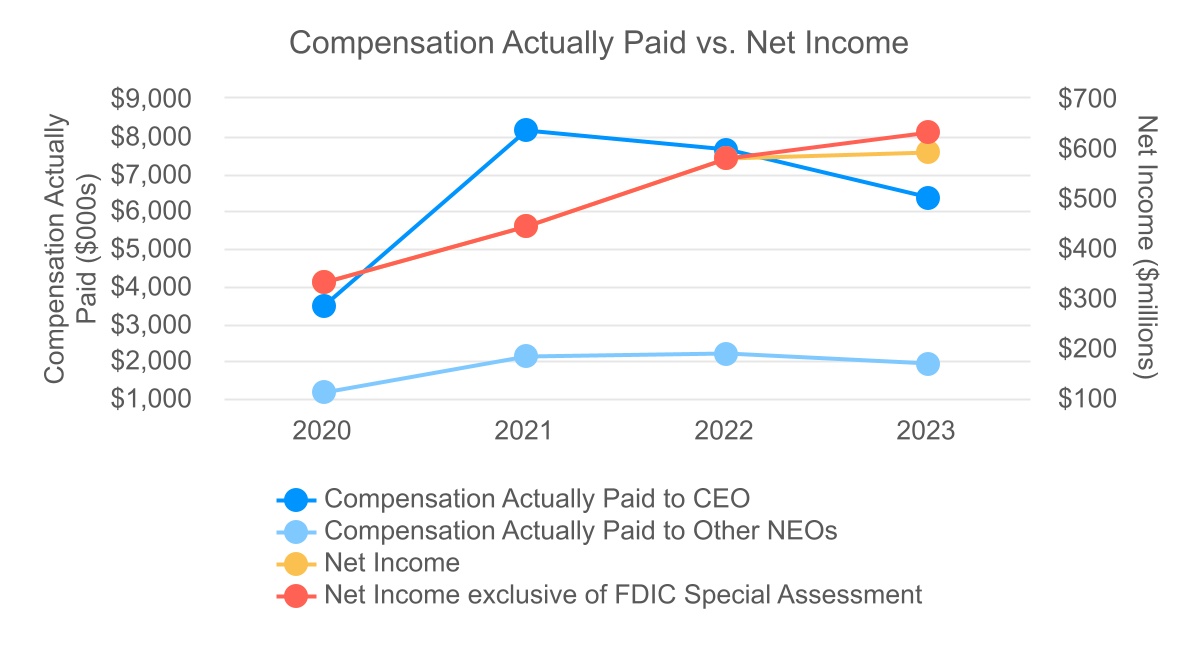

Key Elements of our 2023 Executive Compensation Program

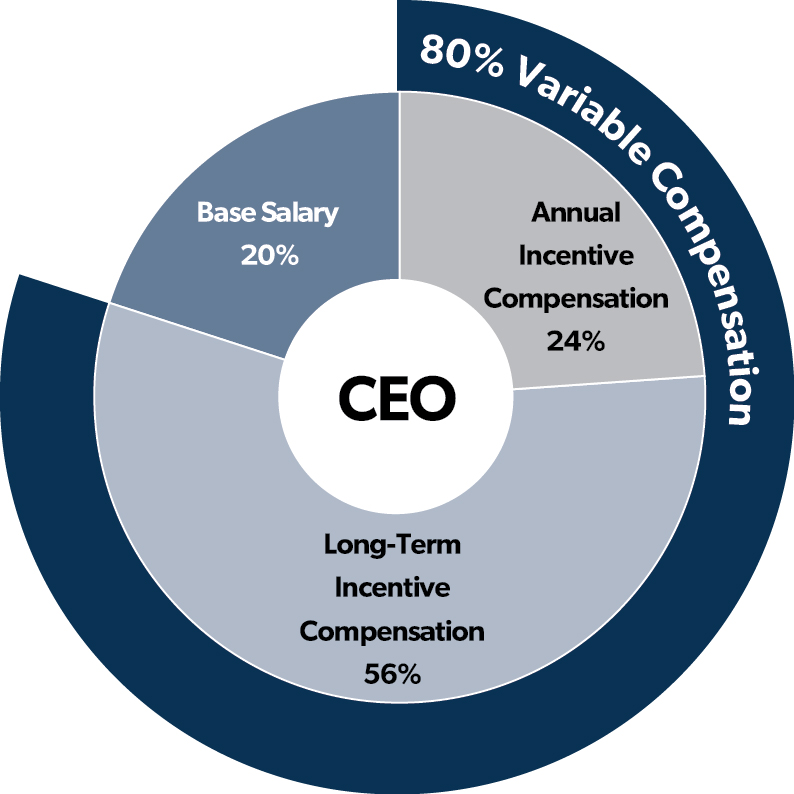

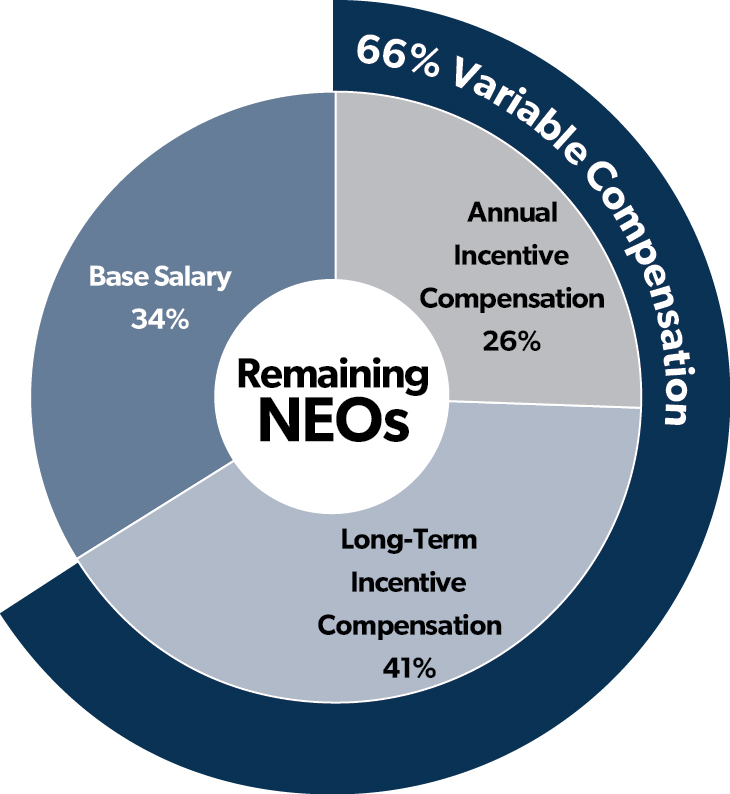

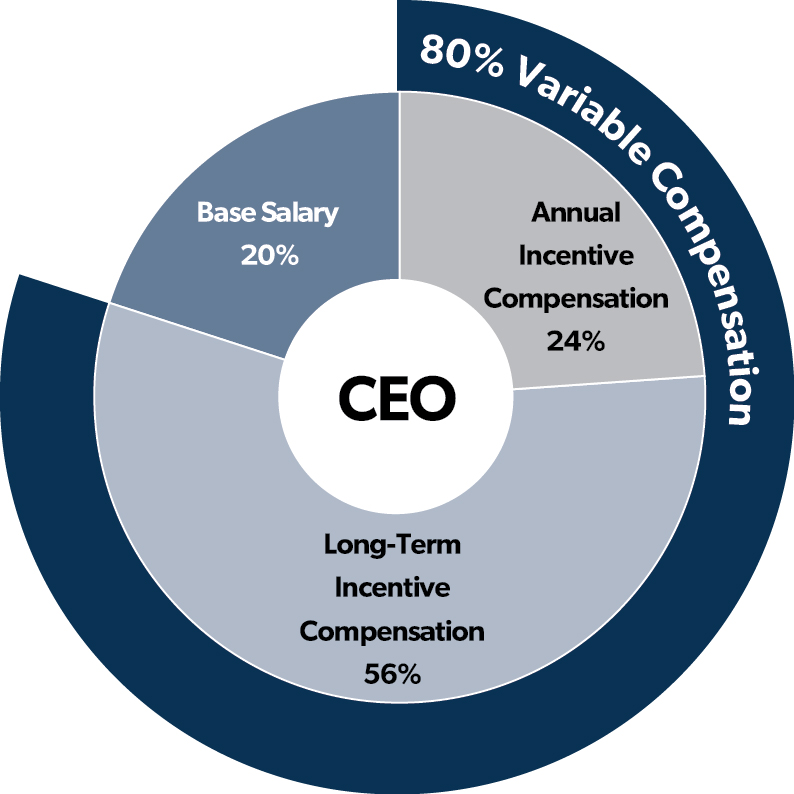

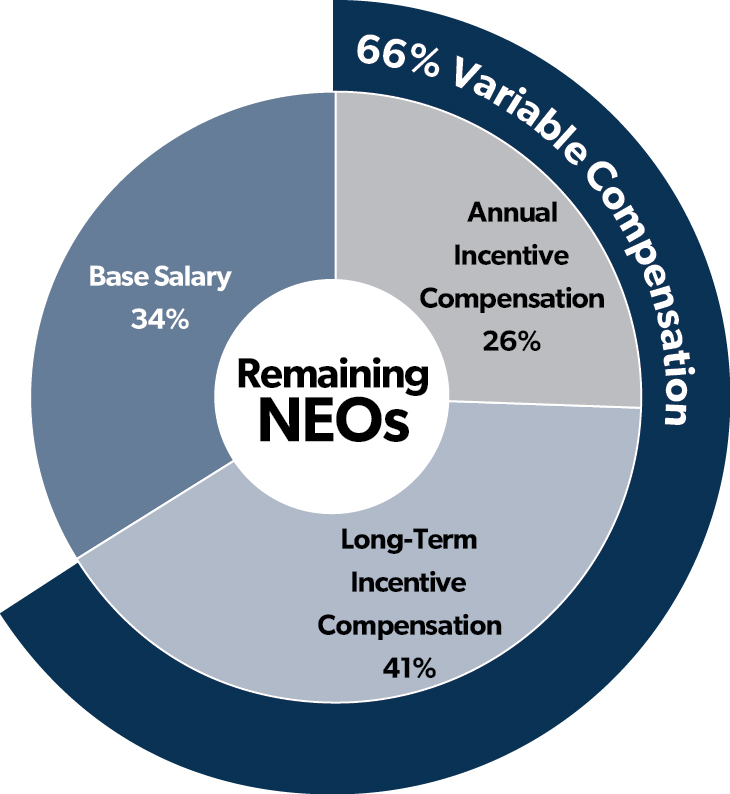

Our compensation mix is heavily performance-based with 80% of the

plan’s trustees or administrators, such shares will be votedCEO’s and 66% of the other Named Executive Officers’ average annualized target compensation at-risk and contingent upon the achievement of performance objectives. Additionally, 56% of the CEO’s and 41% of the other Named Executive Officers' average compensation is in the

same proportion as the shares beneficially owned through such plan for which voting instructions are received, unless otherwise required by law.-2-

Expensesform of Solicitation

Cullen/Frost will pay the expenses of the solicitation of proxies for the Annual Meeting. In addition to the solicitation of proxies by mail, Directors, officers, and employees of Cullen/Frost may solicit proxies by telephone, facsimile, in person or by other means of communication. Cullen/Frost also has retained Okapi Partners LLC (���Okapi”) to assist with the solicitation of proxies. Directors, officers, and employees of Cullen/Frost will receive no additional compensation for the solicitation of proxies, and Okapi will receive a fee not to exceed $8,000.00, plus reimbursement forout-of-pocket expenses. Cullen/Frost has requested that brokers, nominees, fiduciaries and other custodians forward proxy-soliciting material to the beneficial owners of Cullen/Frost Common Stock. Cullen/Frost will reimburse these persons forout-of-pocket expenses they incur in connection with its request.

-3-

long-term incentives. ELECTION OF DIRECTORS

(Item 1 On Proxy Card)

The following fourteen nominees have been nominated to serve for a newone-year term: Mr. Carlos Alvarez, Dr. Chris M. Avery, Mr. Samuel G. Dawson, Mr. Crawford H. Edwards, Mr. Patrick B. Frost, Mr. Phillip D. Green, Mr. David J. Haemisegger, Mr. Jarvis V. Hollingsworth, Mrs. Karen E. Jennings, Mr. Richard M. Kleberg, III, Mr. Charles W. Matthews, Mrs. Ida Clement Steen, Mr. Graham Weston and Mr. Horace Wilkins, Jr. The Board recommends that you vote “FOR” each of the fourteen nominees. If any nominee is unable to serve, the individuals named as proxies on the enclosed proxy card will vote the shares to elect the remaining nominees and any substitute nominee or nominees designated by the Board.

The table below provides information on each nominee.

Nominees forOne-Year Term Expiring in 2019:

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Shares Owned(1) | |

Name | | Age | | | Principal Occupation During Past Five Years | | Director

Since | | | Amount and

Nature of

Beneficial

Ownership | | | Percent | |

| | | | | |

Carlos Alvarez | | | 67 | | | Chairman and Chief Executive Officer, The Gambrinus Company | | | 2001 | | | | 375,337 | | | | 0.59 | % |

| | | | | |

Chris M. Avery | | | 63 | | | Chairman, President and Chief Executive Officer, James Avery Craftsman, Inc. | | | 2015 | | | | 6,051 | | | | 0.01 | % |

| | | | | |

Samuel G. Dawson | | | 57 | | | Chief Executive Officer, Pape-Dawson Engineers, Inc. | | | 2017 | | | | 419 | | | | — | % |

| | | | | |

Crawford H. Edwards | | | 59 | | | President, Cassco Development Company | | | 2005 | | | | 264,202 | (2) | | | 0.42 | % |

| | | | | |

Patrick B. Frost | | | 58 | | | President, Frost Bank, a Cullen/ Frost subsidiary | | | 1997 | | | | 960,712 | (3,4) | | | 1.51 | % |

| | | | | |

Phillip D. Green | | | 63 | | | Chairman of the Board and Chief Executive Officer of Cullen/Frost; Chairman of the Board and Chief Executive Officer of Frost Bank, a Cullen/Frost subsidiary | | | 2016 | | | | 253,367 | (3,5) | | | 0.40 | % |

| | | | | |

David J. Haemisegger | | | 64 | | | President, NorthPark Management Company | | | 2008 | | | | 4,811 | | | | 0.01 | % |

| | | | | |

Jarvis V. Hollingsworth | | | 55 | | | Partner, Bracewell LLP | | | — | | | | — | | | | — | |

| | | | | |

Karen E. Jennings | | | 67 | | | Former Senior Executive Vice President, Advertising and Corporate Communications, AT&T Inc. | | | 2001 | | | | 7,437 | | | | 0.01 | % |

| | | | | |

Richard M. Kleberg, III | | | 75 | | | Investments | | | 1992 | | | | 41,762 | (6) | | | 0.07 | % |

| | | | | |

Charles W. Matthews | | | 73 | | | Former Vice President, General Counsel of Exxon Mobil Corporation | | | 2010 | | | | 5,631 | | | | 0.01 | % |

-4-

Nominees forOne-Year Term Expiring in 2019 (continued):

| | | | | | | | | | | | | | | | | | |

| | | | | |

Ida Clement Steen | | | 65 | | | Investments | | | 1996 | | | | 7,599 | (7) | | | 0.01 | % |

| | | | | |

Graham Weston | | | 54 | | | Co-founder and former CEO of Rackspace Hosting, Inc. | | | 2017 | | | | 22,500 | | | | 0.04 | % |

| | | | | |

Horace Wilkins, Jr. | | | 67 | | | Former President, Special Markets, AT&T Inc.; former Regional President, AT&T Inc. | | | 1997 | | | | 5,737 | | | | 0.01 | % |

| (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pay for Performance | | BeneficialCompensation Policies | | What We Don't Do |

| | | | | | | | | |

| | | | | | | | | |

| ☑ | A substantial portion of our CEO and Named Executive Officers' compensation is at-risk and performance-based. | | | ☑ | Prohibition on pledging and hedging Company stock. | | | ☒ | No single-trigger severance payments or vesting following a change in control. |

| | | | | | | | | |

| ☑ | Benchmark compensation against a representative peer group that is reviewed on an annual basis. | | | ☑ | Clawback policy for executive officers. | | | ☒ | No excise tax gross up payments. |

| | | | | | | | | |

| ☑ | Require minimum thresholds and maximum award caps. | | | ☑ | Robust stock ownership is stated as of January 31, 2018. The owners have sole voting and sole investment powerguidelines for the shares of Cullen/Frost Common Stock reported unless otherwise indicated. The amount beneficially owned also includes deferred stock units granted to eachnon-employee Director, with delivery of the underlying Cullen/Frost Common Stock deferred until that Director ceases to be a member of the Board. The number of shares of Cullen/Frost Common Stock beneficially owned by all Directors, nomineesdirectors and executive officers as aofficers. | | | ☒ | No excessive perquisites. |

| | | | | | | | | |

| ☑ | Performance share unit measure is aligned with creating long-term shareholder value. | | | ☑ | Annual assessment of peer group is disclosed on page 46.composition and compensation related risks. | | | ☒ | No employment agreements for our executives. |

| (2) | Includes (a) 74,118 shares held by three trusts of which Mr. Edwards is a trustee, and, (b) 53,617 shares held by a trust of which Mr. Edwards is the trustee and for which voting and investment power rests with the majority of three trustees of the trust. | | | | | | | |

(3) | Includes the following shares allocated under the 401(k) Stock Purchase Plan for Employees of Cullen/Frost Bankers, Inc., for which each beneficial owner has both sole voting and sole investment power: Mr. Patrick B. Frost 33,930 and Mr. Phillip D. Green 40,701. |

(4) | Includes (a) 707,493 shares held by a limited partnership of which the general partner is a limited liability company of which Mr. Frost is the sole manager, (b) 3,855 shares held by Mr. Frost’s children for which Mr. Frost is the custodian and (c) 630 shares held by Mr. Frost’s wife for which Mr. Frost disclaims beneficial ownership. With respect to the 707,493 shares held by a limited partnership, Mr. Frost has sole voting rights over all shares, sole investment power over 70,749 shares and shared investment power over 636,744 shares. |

(5) | Includes (a) 27,841 shares held by six trusts of which Mr. Green is a trustee, (b) 1,100 shares held by Mr. Green’s wife for which Mr. Green disclaims beneficial ownership. |

(6) | Includes 8,400 shares held by a family partnership for which Mr. Kleberg has sole voting and sole investment power. |

(7) | Includes 200 shares in a trust for which Mrs. Steen shares voting and investment power with her husband. |

-5-

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 6

GENERAL INFORMATION ABOUT THE BOARD OF DIRECTORS

The Board of Directors had sixhad five meetings in 2017. Each2023. All of Cullen/Frost’s Directorsthe directors attended 100% of the meetings of the Board and the Committees of the Board on which he or she served during 2017.2023, with the exception of three directors who each attended more than 75% of the meetings.

The Board has a policy which encourages all

Directorsdirectors to attend the Annual Meeting of

Shareholders, and in 2017 fourteen out of fifteen DirectorsShareholders. All directors except two attended the

20172023 Annual Meeting of Shareholders.

2018 Announced Leadership Changes

On January 24, 2018, Mr. Ruben M. Escobedo notified Cullen/Frost of his decision not to stand forre-election to the Board when his term expires at the Annual Meeting on April 25, 2018. Mr. Escobedo has served on the Board of Cullen/Frost since 1996 and on the Board of Frost Bank since 1993 (then known as Frost National Bank).

Also on January 24, 2018, Mr. R. Denny Alexander notified Cullen/Frost of his decision not to stand forre-election to the Board when his term expires at the Annual Meeting on April 25, 2018. Mr. Alexander joined the Board in 1998 in connection with Cullen/Frost’s acquisition of Overton Bancshares, Inc.

In connection with the retirements of Mr. Escobedo and Mr. Alexander, the Board has nominated Mr. Jarvis V. Hollingsworth to stand for election to the Board at the Annual Meeting.

The Board has sevensix Committees, each of which is described in the chart below,below, along with the current membership. | | | | | | | | | | | |

| Committee | Members (*Chair) | Primary Responsibilities | | | | | | Meetings in 2023 |

| Committee

| | Members

| Primary Responsibilities

| | Meetings

in 2017

| |

| Audit | | | |

Audit

| | Ruben M. Escobedo (Chair)

Cynthia J. Comparin* Hope Andrade Anthony R. Chase Samuel G. Dawson David J. Haemisegger Charles W. Matthews Horace Wilkins, Jr. Linda B. Rutherford | | •Assists the Board in its oversight of the integrity of Cullen/Frost’sour financial statements, Cullen/Frost’s compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, and the performance of the independent auditors and Cullen/Frost’sour internal audit function. •Appoints, compensates, retains and oversees the independent auditors, andpre-approves all audit andnon-audit services. | | | 6 | 5 |

| | | |

Compensation and Benefits | | Charles W. Matthews (Chair)Matthews* Chris M. Avery Ruben M. Escobedo

Karen E. Jennings

Anthony R. Chase Samuel G. Dawson Joseph A. Pierce Linda B. Rutherford Jack Willome | | • OverseesOversight of the development and implementation of Cullen/Frost’sour compensation and benefits programs. •Reviews and approves the corporate goals and objectives relevant to the compensation of the CEO,Chief Executive Officer (the "CEO"), evaluates the CEO’s performance based on those goals and objectives, and sets the CEO’s compensation based on the evaluation. • Oversees the administrationOversight of Cullen/Frost’s compensation and benefits plans.human capital management. | | | 4 | |

-6-

| | | | | | | | |

Committee

| | Members

| | Primary Responsibilities

| | Meetings

in 2017

| |

| | | |

Corporate Governance and Nominating | | Charles W. Matthews (Chair)Matthews* Chris M. Avery Ruben M. Escobedo

Ida Clement Steen

Anthony R. Chase Samuel G. Dawson Joseph A. Pierce Linda B. Rutherford Jack Willome | | •Maintains and reviews Cullen/Frost’sour corporate governance principles.guidelines. • OverseesOversight of and establishes procedures for the evaluation of the Board. •Identifies and recommends candidates for election to the Board. •Reviews related party transactions. •Responsible for CEO succession plan discussions. •Oversight of our ESG business strategy. | 2 |

| | | | 3 | |

| Executive | | | |

Executive

| | Phillip D. Green (Chair) Green* Charles W. Matthews | | •Acts for the Board in between meetings, except as limited by resolutions of the Board, Cullen/Frost’sour Articles of Incorporation orBy-laws, Bylaws, and applicable law.

| 2 |

| | | | 2 | |

| Risk | | | |

Risk

| | Horace Wilkins, Jr. (Chair)

Samuel G. Dawson

Crawford H. EdwardsEdwards* Carlos Alvarez Hope Andrade Patrick B. Frost Karen E. Jennings

Richard M. Kleberg III

Phillip D. Green David H. Haemisegger Charles W. Matthews Jack Willome

| | • Oversees Cullen/Frost’sOversight of our long-term strategy development and implementation and exercise of fiduciary duties. •Oversight of our enterprise risk management framework, including policies, procedures, strategies and systems established to measure, mitigate, monitor and report major risks. •Assists Board oversight across the organization for the types of risks to which Cullen/Frost iswe are exposed, including: credit, operational, compliance/regulatory, liquidity and reputation. | 4 |

| | | | 7 | |

| Technology | | | |

Strategic Planning

| | Phillip D. Green (Chair) Carlos Alvarez

Carlos Alvarez Cynthia J. Comparin Crawford H. Edwards Charles W. Matthews Graham Weston Joseph A. Pierce

| | • Analyzes the strategic direction for Cullen/Frost, including reviewingshort-term and long-term goals.• Monitors Cullen/Frost’s corporate mission statement and capital planning.

| | | 5 | |

| | | |

Technology

| | Graham Weston (Chair)

Crawford H. Edwards David J. Haemisegger Charles W. Matthews Horace Wilkins, Jr.

| | • Oversight of Cullen/Frost’sour information technology projects and information technology security.

security, including cybersecurity. | | | 2 | 4 |

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 7

The Board has adopted written charters offor the Audit Committee, the Compensation and Benefits Committee, the Corporate Governance and Nominating Committee, the Risk Committee and the Technology Committee. All of these charters are available at frostbank.cominvestor.frostbank.com or in print to any shareholder making a request by contacting the Corporate Secretary, at 100111 West Houston Street, Suite 100, San Antonio, Texas 78205.

As described in more detail below under

“Certain Corporate"Corporate Governance Matters—Director Independence,

”" the Board has determined that each member of the Audit Committee, the Compensation and Benefits Committee, and the Corporate Governance and Nominating Committee

and a majority of the members of the Risk Committee, are “independent directors”is independent within the meaning of the rules of the

NYSE.New York Stock Exchange, Inc. ("NYSE"). The Board has also determined that each member of the Audit Committee is independent within the meaning of the rules of the SEC. In addition, the Board has determined that each member of the Audit Committee is

“financially literate”"financially literate" and that at least one member of the Audit Committee has

“accounting"accounting or related financial management expertise,

”" in each case within the meaning of the

NYSE’sNYSE's rules. The Board has also determined that Mr.

David J.Chase, Ms. Comparin and Mr. Haemisegger

is an “auditare "audit committee financial

expert”experts" within the meaning of the

SEC’sSEC's rules.

-7-

As provided in our Corporate Governance Guidelines, our Board selects its Chair,Chairman, Lead Director and CEO in a way that it considers to be in the best interests of Cullen/Frost. The Board does not have a policy on whether the role of ChairChairman and CEO should be separate or combined, but believes that the most effective leadership structure for Cullen/Frostus is to combine these responsibilities. This structure avoids the potential confusion and conflict over who is leading the Company, both within the Company and when dealing with investors, customers and counterparties, and the duplication of efforts that can result from the roles being separated. The Board also believes that combining these roles in one person enhances accountability for the performance of Cullen/Frost.our performance. Furthermore, as Cullen/Frost haswe have traditionally combined these roles, (for some 30+ years now), separating them could cause significant disruption in oversight and lines of reporting. Nevertheless, depending upon

| | | | | |

| Powers and Duties of our Lead Director |

| |

•Provides independent leadership | •Leads the annual CEO evaluation |

•Serves as an advisor to the Chairman | •Presides at executive sessions of the independent directors |

•Engages with other directors as needed in between Board and Committee meetings | •Provides guidance to the Chairman on Board composition and refreshment |

•Presides at any Board meeting at which the Chairman is not present | •Oversight of the Board's governance processes, including Board evaluations, succession planning and other governance-related matters |

•Reviews the agenda, schedule, and materials for each Board meeting in advance | |

| |

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 8

Risk Oversight | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Board of Directors | | |

| | | | | | | | |

|

The Board is responsible for overseeing the strategy and operations of the Company, including risk oversight. The Board interacts on a regular basis with executive officers, from both the control and line of business sides of the Company. Furthermore, members of the Board of Cullen/Frost also serve as members of the Board of Frost Bank (including corresponding committees thereof), and as such receive regular reports on the operations of Frost Bank. It is through these various channels that the Board receives the necessary information to oversee the Company’s risk management. The Boards of Cullen/Frost and Frost Bank, and their relevant committees, typically meet in joint session.

| |

| | | | ⇅ | | | | |

| | | | | | | | |

| | Risk Committee | | Audit Committee | | |

| | | | | | | | |

| | Primary responsibility for oversight of our risk management policies including:

•Oversight of compliance with all regulatory obligations under federal and state banking laws, rules, and regulations

•Oversight of our enterprise risk management framework

•Oversight of liquidity, credit, interest rate, and operational risks

| | Oversight of risks related to:

•Financial reporting, including internal controls

•Legal matters

•Qualifications of the independent auditors •Compliance with legal and regulatory requirements that may have an effect on the financial statements

| | |

| | | | |

| | | | | | | | |

| | Compensation and Benefits Committee | | Corporate Governance and Nominating Committee | | |

| | | | | | | | |

| | Oversight of risks related to:

•Our compensation programs and practices

•Human capital management, including diversity, equity, and inclusion and talent retention

•Executive succession

| | Oversight of risks related to:

•Corporate governance policies and practices

•Director succession and refreshment

•Our sustainability program

| | |

| | | | |

| | | | |

| | | | | | | | |

| | Technology Committee | | |

| | | | | | | | |

| | Oversight of risks related to technology, information security, and third party risks, including cybersecurity and emerging risks as well as mitigation factors and disaster recovery capabilities. | | |

| | | | | | | | |

| | | | | | | | |

| | | | ⇅ | | | | |

| | Role of Management | | |

| | | | | | | | |

| | | | | | | | |

| While the Board and its Committees oversee risk management, the Company's senior management is responsible for identifying, assessing and mitigating risk on a day-to-day basis. The Company's senior management regularly report to the Board and its Committees on various risks and opportunities facing our business. Our management team also periodically reviews with the Board specific risk analyses, such as sensitivity and scenario analyses. | |

| | |

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 9

Cybersecurity Risk Management and Oversight

Cybersecurity is a critical component of our enterprise risk management program. The objective and intended design of our cybersecurity program is to reduce the circumstances,likelihood and severity of cybersecurity incidents and to protect and preserve the confidentiality, integrity and availability of our information systems and our customers' information.

•As part of its ultimate oversight of our cybersecurity program, our Board has delegated relevant responsibilities to certain management committees, as further discussed below, and has delegated to the Technology Committee principal responsibility for overseeing our information security and technology programs, including management’s actions to identify, assess, mitigate, and remediate material cyber issues and risks. At least one member of the Technology Committee must be experienced in information security and technology risk. Cynthia Comparin, a current member of the Technology Committee, holds a certificate of Systemic Cyber Risk Governance for Corporate Directors. Our Chief Information Security Officer ("CISO") and our Chief Information Officer ("CIO") provide quarterly reports to the Technology Committee regarding information security and technology programs, key enterprise cyber initiatives, and significant cybersecurity and privacy incidents. The Technology Committee reviews and approves our information security and technology budgets and strategies annually. Additionally, the Risk Committee reviews our cybersecurity risk profile on a quarterly basis. The Technology Committee and Risk Committee of our Board each provide a report of their activities to the full Board at each Board meeting.

•Our CISO is part of the risk management function, reporting directly to the Chief Risk Officer, who in turn, reports directly to our CEO. Our CISO is accountable for managing our enterprise information security department and delivering our information security program. Various management committees approved by the Board, could chooseincluding the Information Technology Risk Committee and the Information Security Oversight Committee, provide oversight and governance of the information security program and the technology program. These committees generally meet monthly and summaries of key issues discussed and actions taken are provided to separate the rolesTechnology Committee.

•We structure our information security program around the National Institute of ChairStandards and CEOTechnology ("NIST") Cybersecurity Framework, regulatory guidance, and other industry standards. In addition, we leverage certain industry and government associations, third-party benchmarking, audits and threat intelligence feeds to promote program effectiveness. Our CISO and CIO, along with key members of their teams, regularly collaborate with peer banks, industry groups, and policymakers.

•We employ an in-depth, layered, defensive strategy that embraces a "trust by design" philosophy when designing new products, services and technology. We leverage people, processes and technology to manage and maintain cybersecurity controls. We employ a variety of preventative and detective tools designed to monitor, block, and provide alerts regarding suspicious activity, as well as to report on any suspected advanced persistent threats.

•We have established processes and systems to mitigate cyber risk, including regular education and training, preparedness simulations and tabletop exercises, and recovery and resilience tests. Our processes, systems and controls are reviewed periodically by internal and external auditors, and independent external partners to assess design and operating effectiveness. We also maintain information security risk insurance coverage.

•We maintain a third-party risk management program designed to identify, assess and manage risks associated with external services providers and our supply chain. We also maintain an Incident Response Plan that provides a documented framework for responding to security incidents, including timely notification of the Technology Committee. The Incident Response Plan facilitates coordination across multiple parts of the organization and is tested at least annually. We have not experienced a material cybersecurity breach in the future.To help ensure stronglast three years.

Cybersecurity poses a significant risk to us and third parties with which we interact, including our vendors and customers. For more information regarding cybersecurity risk, see Items 1A. Risk Factors and Item 1C. Cybersecurity in our Annual Report on Form 10-K for the year ended December 31, 2023.

Oversight of Compliance and Ethical Conduct

Our Board through its oversight byobligations and ournon-management directors, executive management team work together to comply with laws and regulations, as well as to provide guidance for sound decision-making and accountability. We are committed to maintaining the core values of our Company, as well as high ethical standards which are integral to running a sound, successful, and sustainable business. We do what is right even when it is not easy. We apply this standard in all our relationships: with each other, our customers, our shareholders, our communities and our external partners.

Our Risk Committee provides oversight for our compliance functions and regularly receives compliance risk updates including reports on bank compliance risk, fiduciary compliance risk, and Bank Secrecy Act compliance risk as well as customer complaint trends. The Risk Committee also reviews and approves certain policies related to the compliance function on an annual basis. Our Audit Committee Corporate Governanceoversees the establishment of our procedures for the receipt, retention and Nominating Committee,treatment of complaints from employees, customers, suppliers, shareholders or others related to accounting and

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 10

financial processes and reporting, internal controls, and auditing matters, including procedures for the confidential, anonymous submission of concerns regarding those matters. Our Compensation and Benefits Committee

are composed only of independent directors, and our Risk Committee is composed of a majority of independent directors. In accordance with our Corporate Governance Guidelines, the Chair of the Corporate Governance and Nominating Committee acts as the Lead Director and presides at executive sessions ofnon-management directors and presents to the full Board any matters that may need to be considered by the full Board. Mr. Charles W. Matthews, the current Lead Director, also is the Chair of the Compensation and Benefits Committee and is a member of several other Board committees. As a result, the Lead Director is fully informed of all activities of the Board and most of its committees. In addition to presiding at the executive sessions of thenon-management directors, the Lead Director alsoannually reviews the

agenda, scheduleCode of Business Conduct and

materials for each Board Meeting and Board committee meeting (for each committee on which he sits) and executive session, and facilitates communication between thenon-management directors and the Chair and CEO.The Board is responsible for overseeing all aspects of management of Cullen/Frost, including risk oversight, which is effected primarily through the Audit and Risk Committees. The Risk Committee assists the Board in fulfilling its responsibilities for oversight of the Company’s enterprise-wide risk management framework, including reviewing the Company’s overall risk appetite, risk management strategy and the policies and practices established by the Company’s management to identify and manage risk to the Company. The Audit Committee receives reports on, and reviews, Frost Bank’s principal risk exposure, including financial reporting, credit, and liquidity risk. Cullen/Frost management regularly discusses macro-economic and business-specific factors with the Audit Committee and the Risk Committee,Ethics as well as the potential impactEmployee Standards of these factorsConduct Policy, which is intended to supplement the Code of Business Conduct and Ethics and includes principles and procedures on the risk profile (including the financial situation) of the Company. Cullen/Frost management also periodically reviews with the Board specific risk analyses,policies such as sensitivitythe treatment of confidential information, fair dealing, conflicts of interest, anti-bribery and scenario analyses. In addition, the Audit Committeeanti-corruption, and the Risk Committee receive written packagesanti-money laundering.

Director Refreshment and

detailed oral postings on various types of risk and other matters (which come from a combination of the Company’s CEO, CFO and Chief Risk Officer) at regularly scheduled meetings. The Board

also interacts on a regular basis with executive officers, from both the control and line of business sides of Cullen/Frost. Furthermore, members of the Board of Cullen/Frost also serve as members of the Board of Directors of Frost Bank, and as such receive regular reports on the operations of Frost Bank. The Board of Directors of Frost Bank has an additional committee, the Wealth Advisors Committee, that is not a committee of the Board of Cullen/Frost. This Frost Bank Board committee has a majority of independent directors and reviews risks and approves policy exceptions in trust services. Each standing committee of the Boards of Cullen/Frost and Frost Bank has oversight responsibility for risks inherent within its area of oversight. It is through these various channels that the Board receives the necessary information to oversee the Company’s risk management. The Boards of Directors of Cullen/Frost and Frost Bank, and their relevant committees, typically meet in joint session.-8-

Director NominationEvaluation Process

The Corporate Governance and Nominating Committee is responsible for identifying individuals qualified to becomeidentifies and recommends new directors using the following process:

| | | | | | | | | | | | | | | | | |

| Evaluation of Board Composition | | The Corporate Governance and Nominating Committee evaluates the Board composition regularly and identifies skills, experience, and capabilities desirable for new directors in light of our business and strategy. |

|

| | | | | |

| Determine Candidate Pool | | In identifying director candidates, the Corporate Governance and Nominating Committee may seek input from management and from current members of the Board. In addition, it may use the services of an outside consultant to identify and recommend candidates. The Corporate Governance and Nominating Committee will also consider candidates recommended by shareholders. |

|

| | | | | |

| Review Recommendations | | In evaluating director candidates, the Corporate Governance and Nominating Committee initially considers the Board's need for additional or replacement directors. It also considers the criteria approved by the Board and set forth in our Corporate Governance Guidelines, which include, among other things: •The candidate's personal qualities (in light of our core values and mission statement); •Accomplishments and reputation in the business community; •The fit of the candidate's skills and personality with those of other directors and candidates; •The ability of the candidate to commit adequate time to Board and committee matters; and •The candidate's contribution to the Board’s overall diversity of viewpoints, background, experience and other demographics. The objective is to maintain a Board that is effective, collegial and responsive to our needs. In addition, considerable emphasis is also given to our mission statement and core values, statutory and regulatory requirements, and the Board’s goal of having a substantial majority of independent directors. |

|

| | | | | |

| Make Recommendations to the Board | | In considering whether candidates satisfy the criteria described above, the Committee initially utilizes the information it receives with any recommendation and other information it otherwise possesses. If it determines, in consultation with other Board members, including the Chairman, that more information is needed, such information will be sought, including by conducting interviews. |

|

| | | | | |

Outcome | | Since 2023, two new independent directors joined our Board with the following skills and traits: •Exemplification of our core values •Executive leadership skills •Significant knowledge of the communities we serve

|

|

| | | | | |

| Onboarding | | We conduct a comprehensive onboarding process to ensure that each new director has a full understanding of the business and to allow the director to make meaningful contributions quickly, which includes a combination of one-on-one sessions with management, written materials, and training. |

|

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 11

Board Evaluation

Board and for recommendingcommittee evaluations play a critical role in ensuring the effectiveness of our Board. The evaluation process is led by our Lead Director.

| | | | | | | | | | | | | | |

| Determine Format | | Each year, our Corporate Governance and Nominating Committee reviews and agrees on the evaluation process. |

|

| | | | |

| Conduct Evaluation | | The Lead Director conducts individual interviews with each director based on the topics laid out below. |

|

| | | | |

| Review Feedback in Executive Sessions | | The findings are reviewed by the Lead Director in the executive session of the Board meeting as well as with the Chairman and CEO separately. |

|

| | | | |

| Respond to Director Input | | Results requiring additional consideration are addressed at subsequent Board and committee meetings and reported back to the full Board, where appropriate. |

|

| | | | |

| | | | | | | | | | | |

| Topics considered during the Board and committee evaluations include: |

| | | |

| • | Board culture | • | Strategic oversight |

| • | Board skills and experience | • | Committee responsibilities |

| • | Director refreshment | • | Board meeting mechanics |

| • | Risk oversight | • | Crisis management |

2023 Director Compensation

Director Compensation Table

| | | | | | | | | | | |

Name(1) | Fees Earned or Paid in Cash ($)(2) | Stock Awards ($)(3) | Total

($) |

| Carlos Alvarez | 85,000 | 79,982 | 164,982 |

| Chris M. Avery | 97,500 | 79,982 | 177,482 |

| Anthony R. Chase | 101,500 | 79,982 | 181,482 |

| Cynthia J. Comparin | 105,000 | 79,982 | 184,982 |

| Samuel G. Dawson | 101,500 | 79,982 | 181,482 |

| Crawford H. Edwards | 95,000 | 79,982 | 174,982 |

| David J. Haemisegger | 94,000 | 79,982 | 173,982 |

| Charles W. Matthews | 169,000 | 79,982 | 248,982 |

| Joseph A. Pierce | 92,500 | 79,982 | 172,482 |

| Linda B. Rutherford | 101,500 | 79,982 | 181,482 |

| Jack Willome | 89,376 | 79,982 | 169,358 |

(1)Ms. Andrade is not included in this table as she was appointed to the Board the nominees to stand for election as Directors.In identifying Director candidates, the Corporate Governanceon January 24, 2024. Messrs. Green and Nominating Committee may seek input from Cullen/Frost’s management and fromFrost are not included in this table because they are a current membersor former executive officer of the Board. In addition, it may useCompany, respectively, and receive no compensation for their service as directors. For further information on the servicescompensation paid to Mr. Green, as well as his holdings of an outside consultant. The Corporate Governancestock awards and Nominating Committee will consider candidates recommended by shareholders. Shareholders who wish to recommend candidates may do so by writingoption awards, see the Compensation Discussion and Analysis section and the 2023 Grants of Plan Based Awards and Outstanding Equity Awards at 2023 Fiscal Year-End tables in this proxy statement.

(2)Amounts shown as Fees Earned or Paid in Cash represent fees paid for serving on the Boards of Directors of both Cullen/Frost and Frost Bank.

(3)Amounts shown represent the grant date fair value of deferred stock units granted to the Corporate Governance and Nominating Committeenon-employee directors determined in accordance with Financial Accounting Standards Board Accounting Standards Codification (FASB ASC) Topic 718. On April 26, 2023, each non-employee director was granted 773 deferred stock units. The closing price of Cullen/Frost Bankers, Inc., c/o Corporate Secretary, 100 West Houston Street, San Antonio, Texas 78205. Recommendations may be submitted at any time. The written recommendation must include the name of the candidate, the number of shares of Cullen/Frost Common Stock owned by the candidate and the information regarding the candidateour stock on that would be included in a proxy statement for the election of Directors pursuant to paragraphs (a), (e) and (f) of Item 401 ofRegulation S-K adopted by the SEC.In evaluating Director candidates, the Corporate Governance and Nominating Committee initially considers the Board’s need for additional or replacement Directors. It also considers the criteria approved by the Board and set forth in Cullen/Frost’s Corporate Governance Guidelines, which include, among other things, the candidate’s personal qualities (in light of Cullen/Frost’s core values and mission statement), accomplishments and reputation in the business community, the fit of the candidate’s skills and personality with those of other Directors and candidates, the ability of the candidate to commit adequate time to Board and committee matters and the candidate’s contribution to the Board’s overall diversity of viewpoints, background experience and other demographics. The objective is to build a Board that is effective, collegial and responsive to the needs of Cullen/Frost. In addition, considerable emphasis is given to Cullen/Frost’s mission statement and core values, statutory and regulatory requirements, and the Board’s goal of having a substantial majority of independent directors.

The Corporate Governance and Nominating Committee evaluates all Director candidates in the same manner, including candidates recommended by shareholders. In considering whether candidates satisfy the criteria described above, the Committee will initially utilize the information it receives with the recommendation and other information it otherwise possesses. If it determines, in consultation with other Board members, including the Chair, that more information is needed, it may, among other things, conduct interviews.

-9-

day was $103.47.

CULLEN/FROST BANKERS, INC. ‖ 2024 PROXY STATEMENT PAGE 12

2017 Director Compensation

2017 Director Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | |

Name(1) | | Fees earned

or paid in

cash(2) | | | Stock

Awards(3) | | | Option

Awards | | | Change in Pension

Value and Nonqualified

Deferred Compensation

Earnings | | | All Other | | | Total | |

| | | | | | |

R. Denny Alexander | | $ | 68,000 | | | $ | 39,960 | | | $ | — | | | $ | — | | | | — | | | $ | 107,960 | |

| | | | | | |

Carlos Alvarez | | | 71,000 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 110,960 | |

| | | | | | |

Chris M. Avery | | | 71,000 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 110,960 | |

| | | | | | |

Royce S. Caldwell | | | 21,000 | | | | — | | | | — | | | | — | | | | — | | | | 21,000 | |

| | | | | | |

Samuel G. Dawson | | | 85,000 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 124,960 | |

| | | | | | |

Crawford H. Edwards | | | 75,000 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 114,960 | |

| | | | | | |

Ruben M. Escobedo | | | 103,500 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 143,460 | |

| | | | | | |

David J. Haemisegger | | | 72,000 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 111,960 | |

| | | | | | |

Karen E. Jennings | | | 78,000 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 117,960 | |

| | | | | | |

Richard M. Kleberg, III | | | 77,000 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 116,960 | |

| | | | | | |

Charles W. Matthews | | | 142,783 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 182,743 | |

| | | | | | |

Ida Clement Steen | | | 82,500 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 122,460 | |

| | | | | | |

Graham Weston | | | 80,906 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 120,866 | |

| | | | | | |

Horace Wilkins, Jr. | | | 91,500 | | | | 39,960 | | | | — | | | | — | | | | — | | | | 131,460 | |

(1) | Mr. Green, Cullen/Frost’s Chief Executive Officer and Mr. Frost, President of Frost Bank, are not included in this table because they are Named Executive Officers of Cullen/Frost and receive no compensation for their service as Directors. For further information on the compensation paid to Mr. Green and Mr. Frost, as well as their holdings of stock awards and option awards, see the Summary Compensation Table (Page 37) and the Grants of Plan-Based Awards Table (Page 39). |

(2) | Amounts shown as Fees earned or paid in cash represent fees paid for serving on the Boards of Directors of both Cullen/Frost and Frost Bank. |

(3) | Amounts shown represent the grant date fair value of Deferred Stock Units granted to thenon-employee Directors during 2017. Eachnon-employee Director was granted 419 Deferred Stock Units on April 27, 2017. The grant date fair value of each Deferred Stock Unit was $95.37, which was the closing price of Cullen/Frost’s stock on that day. |

The following information indicates the aggregate number of

Deferred Stock Unitsdeferred stock units previously awarded and outstanding for the following directors as of December 31,

2017:2023:R. Denny Alexander—5,337;

Carlos Alvarez—5,337;

| | | | | |

| Name | Deferred Stock Units Outstanding

(#) |

| Carlos Alvarez | 9,382 |

| Chris M. Avery | 5,096 |

| Anthony R. Chase | 2,913 |

| Cynthia J. Comparin | 3,497 |

| Samuel G. Dawson | 4,464 |

| Crawford H. Edwards | 9,382 |

| David J. Haemisegger | 8,837 |

| Charles W. Matthews | 7,676 |

| Joseph A. Pierce | 773 |

| Linda B. Rutherford | 1,371 |

| Jack Willome | 773 |

Crawford H. Edwards—5,337;

-10-

David J. Haemisegger—4,792;

Richard M. Kleberg, III—5,337;

Charles W. Matthews—3,631;

Horace Wilkins, Jr.—5,337.

Cullen/Frost employees receive no fees for their services as members of the Board of Directors or any of its committees.Non-employee Directors directors receive an annual cash retainer fee of $40,000 andas well as cash retainer fees for service on Committees either as a fee of $4,000 for each of the duly called Board meetings attended. Each of the Cullen/Frost Directors also serves on the Board of Directors of Frost Bank, a subsidiary of Cullen/Frost. In addition,non-employee Directors receive $1,000 for attending each meeting of a committee of the Board to which they have been appointed, except that the Chair of the Audit Committee receives $1,500 for each meeting of the Audit Committee attended. The Lead Director and the Audit Committee Chair each receive an additional cash retainer of $15,000. All othernon-employeeor a Committee ChairsMember. In addition, non-employee directors receive an annual retainer feeequity grant in the form of $10,000.

Non-employee Directorsdeferred stock units. The deferred stock units are also eligible to receive stock-based compensation each year under Cullen/Frost’s 2015 Omnibus Incentive Plan. In April 2017, eachnon-employee Director in office at that time received 419 Deferred Stock Units. Upon retirement from Cullen/Frost’s Board of Directors,non-employee directors will receive one share of Cullen/Frost’s Common Stock for each Deferred Stock Unit held. The Deferred Stock Units were fully vested upon being awardedgrant and entitle the holders willto receive equivalent dividend payments asat the time such dividends are declared on Cullen/Frost’s Common Stock.

Other Directorships

The following are directorshipsour common stock. Each deferred stock unit held by nominees and Directorsa non-employee director is settled in public companies other than Cullen/Frost or in registered investment companies:

| | | | |

Mr. Matthews

| | | Trinity Industries, Inc. | |

-11-

Director Qualifications

All membersone share of our Board have significant knowledge of the markets that we serve and extensive ties to community and business leaders. Below is additional information about the qualifications of our Directors and Director nominee.

| | |

Carlos Alvarez | | Director since 2001 |

Mr. Carlos Alvarez is chair and chief executive officer of The Gambrinus Company which he founded in 1986 when he movedcommon stock upon retirement from his native Mexico with his family to San Antonio. Gambrinus is a leading U.S. craft brewer and marketer with breweries in Shiner, TX (The Spoetzl Brewery), Portland, OR (Bridge Port Brewing Company), and Berkeley, CA (Trumer Brauerei). He is committed to education and has served on the board of trustees of Davidson College, School Year Abroad and, Saint Mary’s Hall (San Antonio), and is a member of the Chancellor’s Circle for the University of Texas system. Mr. Alvarez has made significant contributions to these and other educational institutions’ endowment programs, particularly those geared toward driving greater international engagement. He is a board member of the World Affairs Council of America (Washington, DC) and the World Affairs Council of San Antonio, of which he previously served as chair. Mr. Alvarez has extensive experience in all facets of business, including a strong background in operations and sales. He has an exceptional understanding of the role marketing strategy and branding plays in the success of a company. It is because of his business acumen, as well as his knowledge of the communities we serve, that our Board has concluded that Mr. Alvarez should continue serving on the Board.

| | |

Chris M. Avery | | Director since 2015 |

Dr. Chris M. Avery is chair, president

The Compensation and

chief executive officer of James Avery Craftsman, Inc., a family-owned company founded by his father in 1954,Benefits Committee has the authority to

create finely crafted jewelry designs. Dr. Avery has served on the James Avery Craftsman, Inc. board of directors since 1989. A licensed physicianreview and

board-certified anesthesiologist, he left his profession as chief of anesthesia at Sid Peterson Memorial Hospital in Kerrville, Texas in 1991 to assist in the transition and direction of the family business. He became president and chief operating officer in 1991 and later assumed the roles of chief executive officer and chair of the board in May 2007. Under his leadership, James Avery Craftsman, Inc. has become a national brand that designs, manufactures and sells jewelry in its own stores across the U.S. Dr. Avery earned a bachelor’s degree in biology from Stephen F. Austin State University and a medical degree from the University of Texas Medical School at San Antonio (now the University of Texas Health Science Center at San Antonio). After an internship in orthopedic surgery, he worked as an ER physician in San Antonio and Kerrville. He completed an anesthesia residency at Medical Center Hospital in San Antonio and began his anesthesia practice in Kerrville. Dr. Avery is president of the Fredericksburg Hospital Authority board of directors and has served the boards of Hill Country Memorial Hospital in Fredericksburg, Texas and Sid Peterson Hospital in Kerrville, Texas. It is because of his experience in business operations and management, as well as his knowledge of the communities we serve, that our Board has concluded that Dr. Avery should continue serving on the Board.-12-

| | |

Samuel G. Dawson | | Director since 2017 |

Samuel G. Dawson is chief executive officer of Pape-Dawson Engineers, Inc. one of the largest and most respected engineering firms in Texas, with offices in San Antonio, Austin, Houston, Dallas and Fort Worth. He graduated from The University of Texas at Austin with a B.S. degree in civil engineering. In addition to managing the engineering firm, Mr. Dawson is a community leader who has contributed countless hours to various Texas organizations. He has served as president or chair of the Greater San Antonio Chamber of Commerce, The University of Texas Engineering Advisory Board, Trinity Baptist Church Deacon Council, The University of Texas at San Antonio Engineering Advisory Council, the Witte Museum Board, Texas Society of Professional Engineers, American Society of Civil Engineers, the Rotary Club of San Antonio, the San Antonio Mobility Coalition, Professional Engineers in Private Practice and The Tobin Center for the Performing Arts. In 2013, Mr. Dawson was inducted into The University of Texas Cockrell School of Engineering Department of Civil, Architectural and Environmental Engineering Academy of Distinguished Alumni. It is because of his business operations and management, as well as his knowledge of the communities we serve, that our Board has concluded that Mr. Dawson should continue serving on the Board.

| | |

Crawford H. Edwards | | Director since 2005 |

Fort Worth native Mr. Crawford H. Edwards is president of Cassco Development Co., Inc. and is the fifth generation of his family involved in managing his family’s ranching business. Since 2005, he has been engaged in the investing in and managing of commercial real estate. After graduating with a bachelor of general studies degree from Texas Christian University (TCU) and the TCU Ranch Management program, he worked as a petroleum landman in Midland, Texas. Mr. Edwards serves on the board of directors of the Texas and Southwestern Cattle Raisers Association, the Southwestern Exposition and Livestock Show and the National Finance Credit Corporation. It is because of this experience, as well as his knowledge of the communities we serve, that our Board has concluded that Mr. Edwards should continue serving on the Board.

| | |

Patrick B. Frost | | Director since 1997 |

Mr. Patrick B. Frost is president of Frost Bank. A native of San Antonio, he earned a Bachelor of Arts degree in Economics from Vanderbilt University and a Masters of Business Administration degree from The University of Texas at Austin. He is the chair of the Audit Committee of The University of Texas Health Science Center and chair of the Santa Rosa Children’s Hospital Foundation. Mr. Frost is also a trustee of the San Antonio Medical Foundation and serves on the board of trustees of United Way of San Antonio. He is on the executive committee of the San Antonio Livestock Exposition, and was advisory council chair of The University of Texas at San Antonio College of Business. Mr. Frost was chair of the local organizing committee for the NCAA Men’s Final Four in 2004, 2008 and 2018 and chair of the Alamo Bowl in 2003 and 2013. It is because of his experience in banking and his many years at Cullen/Frost, as well as his knowledge of the communities we serve, that our Board has concluded that Mr. Frost should continue serving on the Board.

-13-

| | |

Phillip D. Green | | Director since 2016 |